Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Augmented and Virtual Realities: Catalyzing Adoption and User Engagement in Digital Payment Systems

Authors: Sowmyanarayanan Soundararajan Guru

DOI Link: https://doi.org/10.22214/ijraset.2024.63132

Certificate: View Certificate

Abstract

Digital payment systems that incorporate augmented reality (AR) and virtual reality (VR) technologies have the potential to completely transform the retail shopping experience. With the increasing demands of consumers for more personalized and immersive interactions, these emerging technologies present creative ways to improve user engagement and promote the use of digital payment methods. This study examines how AR and VR are vital to the advancement of digital payments, emphasizing how they can change conventional retail payment procedures and produce engaging, user-centered experiences. Through the overlaying of digital data onto the real world, augmented reality allows customers to see real-time product images, prices, and payment options, thereby streamlining transactions [1]. Through interactive product information, augmented reality (AR) applications in retail payments streamline the purchasing process and raise customer satisfaction [2]. In contrast, users can virtually explore and interact with products before making a purchase decision by immersing them in fully simulated environments through virtual reality. Virtual reality payment solutions facilitate safe and easy transactions in immersive virtual marketplaces by providing customized shopping experiences [3]. The integration of augmented reality and virtual reality into digital payment systems can promote user adoption by offering distinctive and captivating experiences. User satisfaction rises as a result of these technologies\' enhanced personalization, convenience, and product visualization [4]. Furthermore, augmented reality and virtual reality can improve payment security through the use of biometric authentication and secure virtual environments. Despite the potential benefits, there are still barriers to widespread adoption of AR and VR in digital payments, including those related to technology limitations, privacy and security concerns, and the need for integration with the present payment infrastructure [5]. In this work, these problems are examined along with possible directions for further research and development in this rapidly evolving field. By leveraging the power of augmented reality and virtual reality, digital payment systems can provide dynamic, user-centric experiences that blur the lines between the physical and digital worlds, ultimately influencing the future of retail transactions.

Introduction

I. INTRODUCTION

In the rapidly evolving retail and digital payments landscape, the combination of augmented reality (AR) and virtual reality (VR) technologies is poised to revolutionize the consumer experience and encourage widespread adoption of state-of-the-art payment solutions. In response to consumers' increasing demand for individualized, immersive, and seamless interactions, these cutting-edge technologies offer a revolutionary approach to conventional payment processes, bridging the gap between the physical and digital worlds.

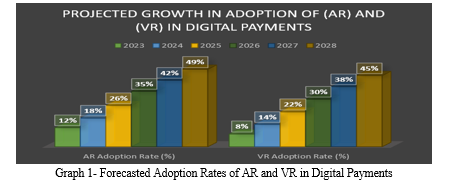

The digital payments ecosystem has experienced remarkable growth in recent times, primarily due to the increasing usage of mobile devices, e-commerce platforms, and evolving consumer preferences [6]. Even though digital payment methods are practical, there are still problems with enhancing user interaction, guaranteeing the security of transactions, and providing personalized shopping experiences. This is where the innovative solutions offered by AR and VR come into play, creating new opportunities for businesses and consumers alike.

By superimposing digital information over the real world, augmented reality has the potential to completely change in-store shopping. Customers can instantly view products, pricing information, and available payment methods when augmented reality (AR) and digital payment systems are integrated. This facilitates smooth transactions and enhances product exploration. Augmented reality (AR) applications in retail payments speed up the purchasing process and increase customer satisfaction by providing interactive product information.

However, because virtual reality immerses users in entirely simulated environments, consumers can virtually explore and interact with products prior to making a purchase decision. VR payment solutions offer personalised shopping experiences by enabling users to safely conduct transactions in these artificial environments and explore lifelike virtual marketplaces. This technology has the potential to completely transform e-commerce by providing a convenient, engaging, and realistic shopping experience from the comforts of home [7].

The integration of augmented reality and virtual reality into digital payment systems has the potential to boost user adoption by offering novel, captivating, and user-focused interactions [8]. These technologies contribute to higher levels of user satisfaction by enhancing product visualization, personalization, and overall convenience. Moreover, payment security can be improved by incorporating cutting-edge encryption methods, secure virtual environments, and biometric authentication into AR and VR [9].

Notwithstanding the encouraging advantages, there are a number of obstacles that must be overcome before AR and VR are widely used in digital payments. These obstacles include those related to technology, privacy and security, and the requirement for integration with current payment infrastructure. In order to better understand how AR and VR can revolutionize retail payment processes, produce engaging and dynamic experiences, and influence the direction of retail transactions, this paper examines the critical roles that AR and VR play in advancing digital payments.

|

Feature |

Augmented Reality (AR) |

Virtual Reality (VR) |

|

Technology |

Overlays digital information on the physical world |

Creates fully immersive digital environments |

|

Retail Applications |

In-store shopping experiences, product visualization, interactive pricing |

Virtual marketplaces, product simulations, virtual try-ons |

|

User Experience |

Enhances the physical shopping environment |

Transports users to a simulated digital world |

|

Payment Integration |

Seamless transactions within the augmented environment |

Secure transactions within virtual environments |

|

Benefits |

Improved product discovery, personalized recommendations, seamless checkout |

Immersive shopping, personalized experiences, convenient browsing |

Table 1 - Comparison of AR and VR in Digital Payments

II. THE ROLE OF AUGMENTED REALITY (AR) IN DIGITAL PAYMENTS

The digital payments industry is about to undergo a radical change thanks to augmented reality, which will change how customers interact with products, prices, and payment options. AR provides a previously unheard-of degree of immersion and interactivity by fusing virtual and real-world elements with ease, opening the door to a genuinely dynamic and captivating shopping experience.

A. Enhancing the In-Store Experience

The potential of augmented reality (AR) to improve in-store shopping is one of the biggest effects on digital payments. When you enter a retail establishment, picture using your smartphone or another AR-capable device to superimpose digital content on the real world. Customers can easily make educated purchasing decisions by having real-time access to product details, pricing, and even virtual try-on capabilities.

Customers can use augmented reality (AR) technology to virtually try on clothing, see how a piece of furniture would look in their living room, and examine the fine details of a product before making a purchase. In addition to enhancing the entire shopping experience, this degree of immersion and interaction also promotes informed decision-making and customer satisfaction.

B. Interactive Product Information

The ability to provide interactive product information is one of the main benefits of augmented reality for digital payments. Conventional techniques for presenting product information and cost frequently fail to convey the complete meaning of a product. However, with augmented reality, customers only need to point their device at a product to access a plethora of information.

The physical object can have interactive 3D models, virtual demonstrations, user reviews, and comprehensive product specifications superimposed on it using augmented reality. Customers are better equipped to make informed decisions about their purchases when there is this degree of information transparency and engagement, which boosts their confidence and contentment with their purchases.

C. Seamless Transactions

Simplifying and streamlining the transaction process is arguably one of the most intriguing uses of augmented reality in digital payments. The ability to finish your purchase without ever having to stand in line at a physical checkout counter is something to imagine. With just a few taps or gestures on their device, users of AR technology can initiate and complete transactions by integrating seamless payment options directly into the augmented environment.

Retailers may give customers a quick and easy checkout experience by combining augmented reality with safe digital payment systems. The augmented reality interface allows customers to scan products, view their virtual shopping cart, and finish the payment process all within it. This eliminates the need for traditional checkout lines and improves the efficiency of the entire shopping experience.

D. Personalized and Engaging Experiences

In addition to improving the usefulness of digital payments, augmented reality opens up new possibilities for engaging and customized experiences. AR systems are capable of customizing virtual try-on experiences, promotional offers, and product recommendations to each individual customer by utilizing user data and preferences.

Imagine getting individualized recommendations based on your past purchase history and preferences, or virtually outfitting a 3D avatar with apparel and accessories. Retailers can now offer highly personalized and captivating experiences thanks to AR technology, strengthening relationships with customers and increasing brand loyalty.

E. The Role of Virtual Reality (VR) in Digital Payments

Virtual reality (VR) transports users into fully simulated digital environments, taking immersion to a whole new level while augmented reality blends virtual elements into the real world. VR offers a smooth and entertaining substitute for traditional online shopping, and it has the potential to completely transform the e-commerce experience in the context of digital payments.

F. Creating Immersive Virtual Shopping Environments

The potential of virtual reality (VR) to create immersive virtual shopping environments is one of the most compelling applications of VR in digital payments.

Imagine being able to enter a virtual shopping center or mall, where you could browse the merchandise and engage with it as though it were real. Traditional e-commerce platforms just cannot match the depth and realism that VR technology brings to the user experience when navigating these simulated environments.

Customers can peruse product displays, view products from various perspectives, and participate in virtual product simulations and demonstrations in these virtual marketplaces. By giving customers a realistic representation of the products they are considering before making a purchase, this degree of immersion and interaction not only improves the overall shopping experience but also helps them make better decisions.

G. Personalized Shopping Experiences

Delivering highly customized shopping experiences based on individual preferences and behaviors is made possible by virtual reality. Advanced algorithms and user data are utilized by VR systems to customize the virtual environment, suggest products, and even assign virtual sales assistants to each customer based on their individual requirements and preferences.

Imagine walking into a virtual store where your shopping preferences and history are used to customize the layout, product displays, and even the background ambiance. Retailers can now create genuinely personalized experiences with VR technology, strengthening customer relationships and increasing brand loyalty.

H. Secure and Convenient Transactions

A primary benefit of incorporating virtual reality (VR) into digital payments is the capacity to provide safe and practical transaction procedures inside the virtual setting. The whole shopping process is streamlined because customers can explore, choose, and buy products without ever leaving the immersive virtual reality environment.

VR solutions can guarantee that transactions are carried out in a secure and reliable manner by utilizing cutting-edge authentication techniques like biometrics and virtual wallets in conjunction with safe digital payment platforms. This resolves any security issues that might be related to conventional e-commerce platforms in addition to improving convenience all around.

I. Virtual Product Demonstrations and Try-Ons

Virtual reality (VR) technology offers a plethora of opportunities for virtually demonstrating and trying on products, giving customers an unmatched degree of involvement and comprehension prior to making a purchase decision. To completely understand the functionality and features of a complex product, like a piece of furniture or an electronic device, picture being able to virtually assemble and interact with it.

Additionally, customers can virtually try on accessories, apparel, and makeup with virtual reality (VR) to see how these products would appear and feel in a lifelike simulation. When purchases match personal preferences and expectations, this degree of interaction can dramatically lower the risk of returns and boost customer satisfaction.

Through the utilization of virtual reality, digital payment systems can surpass the constraints of conventional e-commerce platforms, providing a personalized, immersive, and captivating experience that merges the virtual and real worlds. VR technology's integration with digital payments has the potential to completely change the way consumers shop and transact in the digital sphere as it develops and becomes more widely available.

III. BENEFITS OF AR AND VR IN DIGITAL PAYMENTS

The retail industry could undergo a significant transformation, and the overall customer experience could be improved, by incorporating augmented reality (AR) and virtual reality (VR) into digital payment systems. These cutting-edge technologies not only improve user experience and satisfaction but also drive user adoption, increase sales, and foster a more secure and efficient payment ecosystem.

A. Improved User Experience

Providing a better and more interesting user experience is one of the main advantages of AR and VR in digital payments. Through the creation of fully immersive virtual environments (VR) or the blending of digital information with the physical world (AR), these technologies provide an immersive and interactive experience that traditional payment methods just cannot match.

Personalized shopping experiences, smooth transactions, and interactive product information are all made possible by AR applications in retail payments, which eventually raise customer satisfaction. In a similar vein, virtual reality (VR) solutions let customers virtually inspect products, interact with lifelike simulations, and conduct safe transactions in virtual marketplaces that are truly immersive.

B. Increased Customer Satisfaction

By addressing common issues and providing individualized experiences, the incorporation of AR and VR into digital payment systems has the potential to greatly increase customer satisfaction. By enabling customers to virtually try on clothing or see how furniture would look in their homes, augmented reality (AR) improves product visualization, lowers the chance of returns, and boosts confidence in buying decisions [2].

Conversely, virtual reality (VR) offers incredibly captivating and immersive shopping experiences, allowing clients to explore virtual spaces, engage with products, and receive recommendations that are specifically catered to their interests. Stronger ties between consumers and brands can be created with this degree of personalization and interaction, increasing customer loyalty and repeat business.

C. Driving User Adoption

The innovative and captivating qualities of augmented reality and virtual reality technologies have the potential to stimulate user adoption of digital payment systems. These technologies have the ability to draw in and keep users by providing fresh and interesting interactions, especially from younger, tech-savvy consumers who appreciate unique and interactive experiences [7].

Users may choose to accept these cutting-edge payment methods over more conventional ones if AR and VR are seamlessly incorporated into digital payment processes and make transactions more simple, convenient, and pleasurable [8].

D. Enhanced Security and Privacy

Opportunities to improve the security and privacy of digital payment transactions are also presented by AR and VR technologies. Through the use of biometric authentication techniques, such as facial recognition or iris scanning, users can enter and exit AR or VR environments safely [9].

Furthermore, virtual reality (VR) can offer safe virtual spaces for carrying out sensitive transactions, lowering the possibility of data breaches and guaranteeing user privacy [5]. These advantages for security and privacy can contribute to increasing user confidence and trust in digital payment systems with AR and VR capabilities.

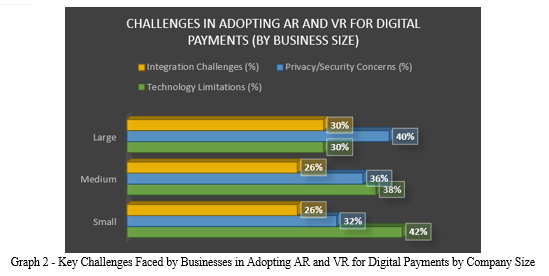

E. Challenges and Future Directions

Although there is great potential for augmented reality (AR) and virtual reality (VR) to be integrated into digital payment systems, there are obstacles to their widespread adoption and use. One of the main obstacles to realizing the full potential of these cutting-edge technologies is the need for seamless integration with current payment infrastructures, privacy and security concerns, and technological limitations.

F. Technological Limitations and Barriers

The seamless integration of AR and VR technologies into digital payment systems is impeded by certain technological barriers and limitations, even with the rapid advancements in these fields. Many consumers and businesses may find it prohibitively expensive to meet the hardware requirements for providing high-quality AR and VR experiences, which include sophisticated displays, powerful processors, and specialized input devices [10]. Furthermore, creating reliable and easy-to-use AR and VR applications is still a difficult task that requires a lot of resources, which makes it difficult for users to adopt them widely [11].

Moreover, incompatibilities may arise due to a lack of standardization and interoperability among various AR and VR platforms and devices, restricting the applicability and scalability of these solutions [12]. The successful integration of AR and VR into digital payment ecosystems will depend on overcoming these technological obstacles through ongoing research, development, and industry collaboration.

G. Privacy and Security Concerns

When incorporating AR and VR into digital payment systems, privacy and security are top priorities, as they are with any technology that manages sensitive financial and personal data. Due to the potential for these technologies to collect and process enormous amounts of user data, such as location data, purchase histories, and biometric information, the use of AR and VR in retail environments raises concerns regarding data privacy [13].

Building user trust and confidence in AR and VR-enabled payment solutions will require ensuring strong data protection measures, putting in place strict encryption protocols, and abiding by pertinent privacy regulations [14]. Proactive security measures and ongoing monitoring are also necessary to mitigate the possibility of cyber threats like malicious AR overlays and phishing attacks based in virtual reality.

H. Integration with Existing Payment Infrastructure

The requirement for seamless integration with current payment infrastructure and systems is one of the major obstacles to the widespread adoption of AR and VR for digital payments. The special needs and features of AR and VR technologies may not be supported by legacy payment platforms and procedures, which could result in incompatibilities and disruptions in the payment workflow.

The development of strong integration standards and strategies involving technology providers, payment processors, financial institutions, and retailers will be necessary to overcome this obstacle. Application programming interfaces (APIs), middleware programs, or completely new payment gateways designed specifically for the AR and VR ecosystems may need to be developed for this [15].

IV. FUTURE DIRECTIONS AND IMPLICATIONS

Numerous implications and future directions arise as the use of AR and VR in digital payments picks up steam. The way that these technologies interact with other cutting-edge developments like blockchain, AI, and the Internet of Things (IoT) has the potential to completely change the landscape of digital payments. While AI and IoT could enable more individualized and context-aware payment experiences, blockchain-based payment solutions combined with AR and VR could improve security, transparency, and decentralization [16].

|

Technology |

Potential Integration with AR/VR in Digital Payments |

|

Blockchain |

Secure transactions, transparency, decentralization |

|

Artificial Intelligence (AI) |

Personalized recommendations, context-aware experiences |

|

Internet of Things (IoT) |

Connected devices, seamless payment ecosystems |

|

5G and Edge Computing |

Improved performance, low-latency experiences |

|

Biometrics |

Secure authentication, enhanced privacy |

Table 2- Future Directions and Convergence with Other Technologies

Moreover, the retail sector may experience significant changes to supply chain operations, customer engagement tactics, and conventional business models if AR and VR are widely used in digital payments. Retailers may need to modify their physical and digital presence as customers grow more accustomed to immersive and interactive shopping experiences in order to stay competitive [17].

Conclusion

The retail industry is changing dramatically as a result of the incorporation of augmented reality (AR) and virtual reality (VR) into digital payment systems. These technologies present hitherto unheard-of chances to improve user adoption, improve customer experiences, and change how we view and engage with the business world. The in-store shopping experience could be completely transformed by augmented reality (AR) technology, as we have shown, since it can seamlessly integrate digital data with the real world. Envision how easy it would be to access information about products, prices, and even virtual try-on features, all while enjoying a smooth and customized payment experience. In addition to enhancing the overall shopping experience, this degree of immersion and interaction encourages wise decision-making and increased customer satisfaction. But before making a purchase, customers can explore and engage with products in a lifelike way thanks to virtual reality (VR), which submerges users in completely simulated virtual environments. These engaging online marketplaces provide individualized shopping experiences, safe and easy transactions, and a level of product engagement that traditional e-commerce platforms just cannot match. By providing innovative, captivating, and user-focused interactions, the incorporation of augmented reality (AR) and virtual reality (VR) into digital payment systems has the potential to propel extensive adoption, even beyond the benefits to users. Modern consumers have changing tastes, and these technologies respond to those needs by offering convenience, personalization, and seamless integration of digital experiences into everyday life. The road to widespread adoption is not without difficulties, though, as is the case with any disruptive innovation. The need for seamless integration with current payment infrastructures, privacy and security concerns, and technological limitations must all be addressed via ongoing research, teamwork, and the creation of strong standards and best practices. Future prospects for improving the digital payments ecosystem are promising, as evidenced by the convergence of AR and VR with other cutting-edge technologies like blockchain, AI, and the Internet of Things. The underlying business models and operations of the retail industry as a whole, as well as the way we shop and transact, could be completely transformed by this synergy. One thing is certain in the constantly changing digital landscape: the merging of the real and virtual worlds is becoming a rapidly approaching reality rather than a far-off idea. At the vanguard of this revolution are augmented reality and virtual reality, which have the potential to expand the possibilities for digital payments and usher in a new era of immersive, customized, and user-focused retail interactions.

References

[1] Rese, A., Baier, D., Geyer-Schulz, A., & Schreiber, S. (2017). How augmented reality apps are accepted by consumers: A comparative analysis using scales and opinions. Technological Forecasting and Social Change, 124, 306-319. https://doi.org/10.1016/j.techfore.2016.10.010 [2] Hilken, T., Müller, J., & Keßler, T. (2020). Augmented reality in retail: A future perspective. Journal of Retailing and Consumer Services, 57, 102206. https://doi.org/10.1016/j.jretconser.2020.102206 [3] Bonetti, F., Warnaby, G., & Quinn, L. (2018). Augmented reality and virtual reality in physical and digital retailing: A review, synthesis and research agenda. In Augmented Reality and Virtual Reality (pp. 119-132). Springer, Cham. https://doi.org/10.1007/978-3-319-64027-3_9 [4] Poushneh, A. (2018). Augmented reality in retail: A trade-off between user\'s control of access to personal information and augmentation quality. Journal of Retailing and Consumer Services, 41, 169-176. https://doi.org/10.1016/j.jretconser.2017.12.010 [5] Olsson, T., & Salo, M. (2011). Online user survey on current mobile augmented reality applications. In 2011 10th IEEE International Symposium on Mixed and Augmented Reality (pp. 75-84). IEEE. https://doi.org/10.1109/ISMAR.2011.6092369 [6] Dahlberg, T., Guo, J., & Ondrus, J. (2015). A critical review of mobile payment research. Electronic Commerce Research and Applications, 14(5), 265-284. https://doi.org/10.1016/j.elerap.2015.07.006 [7] Rau, P. L. P., Zheng, J., Guo, Z., & Li, J. (2018). Speed matters? Behavioural differences between virtual and physical environments for improving users\' spatial cognition. Virtual Reality, 22(1), 65-80. https://doi.org/10.1007/s10055-017-0317-3 [8] Riva, G., Wiederhold, B. K., & Gaggioli, A. (2016). Being present in virtual reality. In The Oxford Handbook of Cyberpsychology (pp. 69-89). Oxford University Press. https://doi.org/10.1093/oxfordhb/9780198712442.013.4 [9] Chowdhury, M. J. M., Colman, A., Kabir, M. A., Han, J., & Sarda, P. (2018). Blockchain as a notarization service for data sharing with personal data analytics. In 2018 17th IEEE International Conference on Trust, Security and Privacy in Computing and Communications/12th IEEE International Conference on Big Data Science and Engineering (TrustCom/BigDataSE) (pp. 1330-1335). IEEE. https://doi.org/10.1109/TrustCom/BigDataSE.2018.00190 [10] Speicher, M., Wallner, G., & Hlavacs, H. (2022). An Overview of Hardware Platforms for Augmented Reality Experiences. Applied Sciences, 12(3), 1342. https://doi.org/10.3390/app12031342 [11] Rios, H., González, E., Rodriguez, C., Siller, H. R., & Huerta, M. (2020). Virtual Reality: A New Immersive Experience in the Development of Mobile Apps. Sensors, 20(16), 4569. https://doi.org/10.3390/s20164569 [12] Takala, T. M., & Matveinen, P. (2022). Interoperability challenges in augmented reality ecosystems. Journal of Systems and Software, 183, 111142. https://doi.org/10.1016/j.jss.2021.111142 [13] Ghazal, T. M., Hasan, M. K., Alshurideh, M. T., Alawadhi, D. M., Alkhalifa, Z. S., Abed, S. S., & Al-Msiedeen, G. M. (2021). Privacy and Security Risks in the Application of Augmented Reality: A Systematic Review. Sensors, 21(11), 3749. https://doi.org/10.3390/s21113749 [14] Pinto, A. M., & Cardoso, H. L. (2022). Augmented Reality Privacy and Security Threats: A Systematic Literature Review. Applied Sciences, 12(4), 1971. https://doi.org/10.3390/app12041971 [15] Lee, S. M., Hwang, J., & Choi, J. (2022). Integration of augmented reality technology into the payment ecosystem: Challenges and implications. Technological Forecasting and Social Change, 177, 121547. https://doi.org/10.1016/j.techfore.2022.121547 [16] Sharma, S., Chen, K., & Sheth, A. (2018). Towards practical blockchain-based augmented reality for the Internet of Things. In Proceedings of the 2nd Workshop on Blockchain-enabled Cyberphysical Systems (pp. 1-6). https://doi.org/10.1145/3209087.3209088 [17] Dacko, S. G. (2017). Enabling smart retail settings via mobile augmented reality shopping apps. Technological Forecasting and Social Change, 124, 243-256. https://doi.org/10.1016/j.techfore.2016.09.032

Copyright

Copyright © 2024 Sowmyanarayanan Soundararajan Guru. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63132

Publish Date : 2024-06-05

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online